On January 11, 2022, the National Assembly approved Resolution 43/2022/QH15 on fiscal and monetary policies to support the program of socio-economic recovery and development.

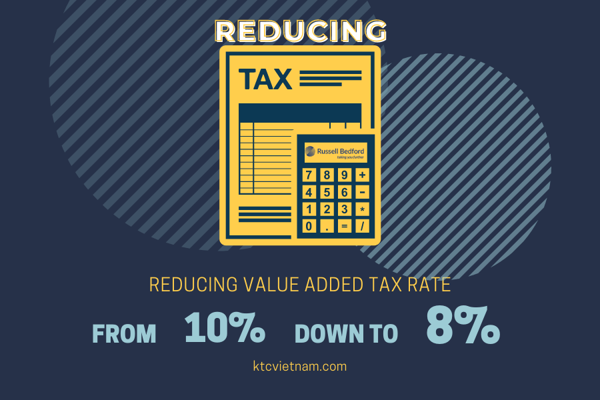

The new resolution stated to reduce the value-added tax rate by 2% in 2022, applicable to groups of goods and services currently having the value-added tax rate of 10% (down to 8%).

The reduction, however, does not apply to the following groups of goods and services: telecommunications, information technology, financial activities, banking, securities, insurance, real estate business, metals, prefabricated metal products, mining products (excluding coal mining), coke, refined petroleum, chemical products, goods and services subjected to special excise duty tax.

Furthermore, businesses and organizations’ expenditures to support and sponsor COVID-19 prevention and control activities in Vietnam within 2022 are deductible when determining corporate income tax.

Contact Russell Bedford KTC for advice on accounting – tax – auditing – corporate finance