UPDATE NEW REGULATIONS

RESOLUTION:

– Resolution 68/NQ-CP issued on 01 July 2021 – On certain policies to support employees and employers in difficulty due to the covid-19 pandemic

NEWSLETTER 7 – 2021

– Resolution 68/NQ-CP issued on 01 July 2021 – On certain policies to support employees and employers in difficulty due to the covid-19 pandemic

1. Reduction in insurance premiums for occupational accidents and diseases:

Employers are entitled to a premium rate of 0% of the salary fund as the basis for paying social insurance premiums to the Insurance Fund for Occupational Accidents and Diseases for 12 months (from 01 July 2021 to 30 June 2022) for employees eligible for occupational accident and disease insurance (except for officials, public employees, people in the people’s armed forces, employees in the agencies of the Party, the State, administrative agencies, public sector entities on the payroll of the state budget). The employer will provide the monetary support obtained from the reduction in premiums to the Insurance fund for occupational accidents and diseases for the employees in order to combat the COVID-19 pandemic

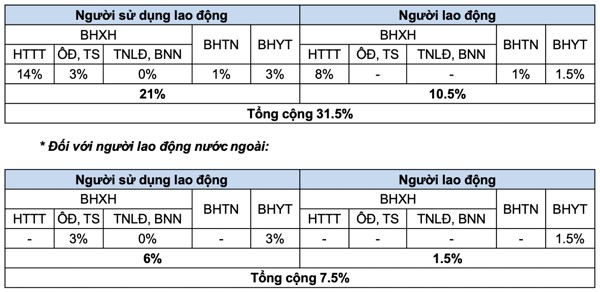

Therefore, the compulsory Social insurance (SI) premiums from 01 July 2021 to 30 June 2022 for the Retirement and survivorship fund, Sickness and maternity fund, Occupational accident and disease fund; Unemployment insurance (UI), health insurance (HI) for employees (except as above) and employers as follows:

Resolution 68/NQ-CP issued on 01 July 2021 – On certain policies to support employees and employers in difficulty due to the covid-19 pandemic

* For Vietnamese employee:

Resolution 68/NQ-CP issued on 01 July 2021 – On certain policies to support employees and employers in difficulty due to the covid-19 pandemic

2. Suspension of contributions to the retirement and survivorship fund:

Regarding employers who have fully paid social insurance premiums or are temporarily suspending contributions to the retirement and survivorship fund until the end of April 2021 but have been affected by the COVID-19 pandemic, resulting in a downsizing of at least 15% employees who have contributed to social insurance compared to April 2021 (including the employees on furlough, suspension of employment contracts, and unpaid leave), the employees and the employers are entitled to a 6-month suspension of payment to the retirement and survivorship fund from the date of application submission. As for a case on the payment suspension under the Resolution No. 42/NQ-CP of 09 April 2020 and Resolution No. 154/NQ-CP of 19 October 2020 of the Government, if the applicant is still qualified, the application will be approved as long as the suspension period does not exceed 12 months.

Resolution 68/NQ-CP issued on 01 July 2021 – On certain policies to support employees and employers in difficulty due to the covid-19 pandemic

3. Loan policy to pay furlough wages, wages for production recovery:

a)Loan to pay furlough wages: The employer is entitled to borrow a loan from the Bank for Social Policies at the interest rate of 0% and is not required to furnish a loan security to pay furlough wages to the employees who have contributed to compulsory social insurance and have been put on furlough for 15 consecutive days or more as prescribed in Clause 3, Article 99 of the Labor Code, from 01 May 2021 to the end of 31 March 2022 The employer must have no bad debt at any credit institution and foreign bank branch at the time of applying for a loan. The maximum loan amount is equal to the regional minimum wage for the number of employees according to the actual payment period of furlough wages but not exceeding 03 months. The loan term is less than 12 months.

Resolution 68/NQ-CP issued on 01 July 2021 – On certain policies to support employees and employers in difficulty due to the covid-19 pandemic

4. Loan policy to pay furlough wages, wages for production recovery (Continued): b) Loan to pay wages for production recovery: The employer is entitled to borrow a loan from the Bank for Social Policies at the interest rate of 0% and is not required to furnish a loan security to pay wages to the employees who have worked under employment contracts and have contributed to compulsory social insurance if it resumes the business after suspending operations at the request of the competent authority to prevent and control the COVID-19 pandemic, from 01 May 2021 to the end of 31 March 2022 and its line of business is in the field of transportation, aviation, tourism, accommodation services, sending Vietnamese workers to work abroad under a contract from 01 May 2021 to the end of 31 March 2021 The employer must have no bad debt at any credit institution and foreign bank branch at the time of applying for a loan The loan term is less than 12 months. The loan term is less than 12 months.